TL;DR

DeepSeek's V4 model launches mid-February 2026 with 1 trillion total parameters, 1-million-token context windows, and three architectural innovations—Manifold-Constrained Hyper-Connections (mHC), Engram conditional memory, and Sparse Attention—that could redefine AI economics. Internal benchmarks claim 80%+ SWE-bench performance at 10-40x lower inference costs than Western competitors. The model runs on dual RTX 4090s, open-sources weights under Apache 2.0 licensing, and represents China's most credible challenge to Western AI dominance since the original DeepSeek shock.

$5.6 million.

That's what DeepSeek reportedly spent training V3—a model matching GPT-4o and Claude 3.5 Sonnet across most benchmarks. OpenAI reportedly spent over $100 million training GPT-4. The gap reveals a fundamental question reshaping AI economics: Does frontier performance require billions in compute, or does architectural innovation offer a cheaper path?

DeepSeek's answer arrives mid-February with V4, a 1-trillion parameter model incorporating three architectural innovations that could deliver what analysts call a "striking breakthrough" in training efficiency. The model targets autonomous coding—not simple snippet generation, but managing entire software repositories with human-level reasoning across million-token context windows.

For data center operators deploying GPU infrastructure, the implications extend beyond benchmark scores. If DeepSeek's efficiency-first approach scales successfully, the economics of AI deployment—and the hardware required to support it—face significant disruption.

Three Architectural Innovations

DeepSeek V4 combines three breakthrough technologies published across late 2025 and early 2026 research papers: Manifold-Constrained Hyper-Connections, Engram conditional memory, and DeepSeek Sparse Attention.

Manifold-Constrained Hyper-Connections (mHC)

DeepSeek's December 31, 2025 paper introduced mHC, a framework addressing fundamental problems in scaling large language models. Traditional hyper-connections can expand residual stream width and improve connectivity patterns, but simultaneously undermine the identity mapping principle that makes residual networks trainable—leading to numerical instability that crashes large-scale training runs.

The mHC solution projects connection matrices onto a mathematical manifold using the Sinkhorn-Knopp algorithm, controlling signal amplification to 1.6x compared to 3000x with unconstrained methods.

| Benchmark | Baseline | HC (Unconstrained) | mHC | Improvement |

|---|---|---|---|---|

| BBH | 43.8 | 48.9 | 51.0 | +7.2 points |

| DROP | 62.1 | 65.4 | 67.8 | +5.7 points |

| GSM8K | 71.2 | 74.8 | 77.3 | +6.1 points |

| MMLU | 68.4 | 71.2 | 73.6 | +5.2 points |

The practical result: a 4× wider residual stream adds only 6.7% training time overhead. Co-authored by founder Liang Wenfeng, mHC enables "aggressive parameter expansion" by bypassing GPU memory constraints—training larger models on hardware that would otherwise limit capacity.

IBM's Principal Research Scientist Kaoutar El Maghraoui stressed that DeepSeek's mHC architecture could revolutionize model pretraining: "It's scaling AI more intelligently rather than just making it bigger."

Engram Conditional Memory

Published January 13, 2026, Engram introduces a conditional memory module that achieves constant-time knowledge retrieval by decoupling static pattern storage from dynamic reasoning. The technology modernizes classic N-gram embeddings to perform O(1) lookups alongside the neural backbone.

Engram addresses what DeepSeek calls "silent LLM waste"—GPU cycles lost to static lookups that don't require active reasoning. The system uses multi-head hashing to map compressed contexts to embedding tables via deterministic functions, avoiding the memory explosion of dense tables while mitigating collisions.

Context-Aware Gating provides the "conditional" aspect. Retrieved embeddings aren't blindly added to the residual stream—they're gated by the current hidden state. If retrieved memory conflicts with global context, the gate suppresses the noise.

DeepSeek's key finding: the optimal split is 75-80% for computation and 20-25% for memory. Pure MoE (100% computation) proved suboptimal.

| Metric | Without Engram | With Engram | Change |

|---|---|---|---|

| Complex Reasoning | 70% | 74% | +4 points |

| Knowledge Retrieval | 57% | 61% | +4 points |

| Needle-in-Haystack | 84.2% | 97.0% | +12.8 points |

| Training Time Impact | Baseline | +6.7% | Minimal |

The researchers demonstrated offloading a 100-billion-parameter embedding table to system DRAM with throughput penalties below 3%. For inference infrastructure, this shifts the hardware calculus—high-bandwidth system memory becomes as valuable as raw GPU FLOPS.

DeepSeek Sparse Attention (DSA)

The third innovation, DeepSeek Sparse Attention, enables million-token context windows while reducing computational overhead by 50% compared to standard Transformers.

The system uses a "lightning indexer" to prioritize specific excerpts from the context window, followed by a "fine-grained token selection system" that chooses specific tokens from those excerpts to load into the model's limited attention window. This allows operation over long portions of context with comparatively small server loads.

Traditional transformer attention scales quadratically with sequence length—doubling context length quadruples compute. DeepSeek's sparse attention cuts this to roughly linear scaling, making the difference between "theoretically possible" and "economically viable" for million-token contexts.

V4 Model Specifications

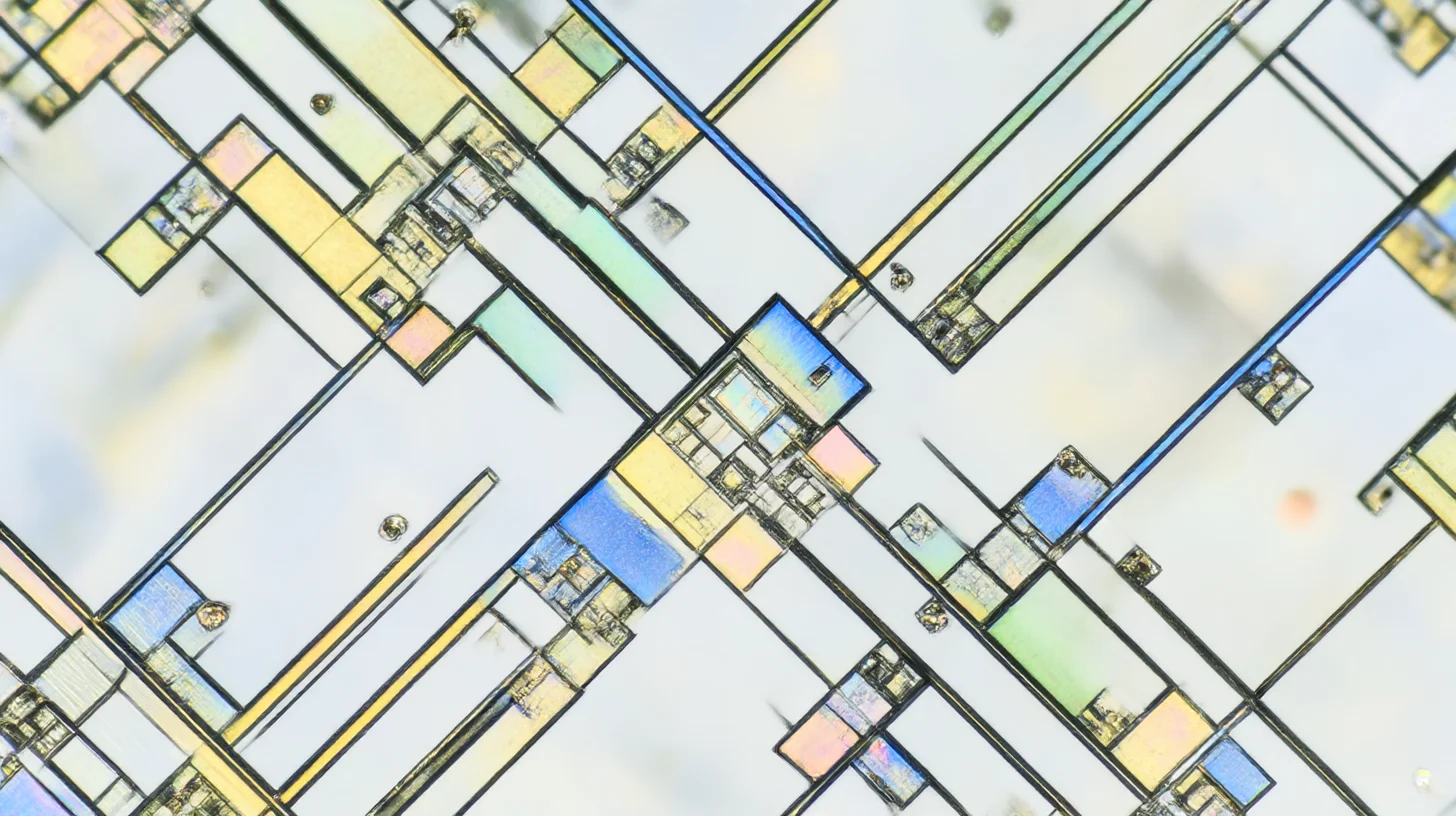

DeepSeek V4 represents a technical marvel of sparse architecture, utilizing 1 trillion total parameters while activating approximately 32 billion for any given token.

| Specification | DeepSeek V4 | GPT-5.2 | Claude Opus 4.5 |

|---|---|---|---|

| Total Parameters | 1 trillion | ~2 trillion (est.) | Undisclosed |

| Active Parameters | 32B | Full model | Undisclosed |

| Context Window | 1M tokens | 256K tokens | 200K tokens |

| Architecture | MoE + mHC + Engram | Dense Transformer | Dense Transformer |

| Training Cost | ~$10M (est.) | ~$500M (est.) | Undisclosed |

| API Input Cost | $0.27/1M tokens | $15/1M tokens | $15/1M tokens |

This "Top-16" routed MoE strategy allows V4 to maintain specialized knowledge of a titan-class system without the crippling latency or hardware requirements usually associated with trillion-parameter models. The practical impact: efficient retrieval from contexts exceeding one million tokens.

For coding tasks, this means V4 can ingest an entire medium-sized codebase, understand import-export relationships across dozens of files, and perform autonomous refactoring. Early testers report true multi-file reasoning where the model understands relationships between components, traces dependencies, and maintains consistency across large-scale refactoring operations.

SWE-Bench: The Defining Benchmark

SWE-bench Verified measures a model's ability to solve real-world GitHub issues—requiring code understanding, debugging, and implementation across actual repository contexts. Claude Opus 4.5 currently leads with 80.9%.

DeepSeek's internal testing reportedly shows V4 exceeding 80% on SWE-bench Verified, outperforming Claude 3.5 Sonnet and GPT-4o, particularly on extremely long code prompts. These claims remain unverified by independent testing.

| Model | SWE-bench Verified | Context Window | API Cost (Input) |

|---|---|---|---|

| Claude Opus 4.5 | 80.9% | 200K tokens | $15/1M tokens |

| GPT-5.2 | 78.2% | 256K tokens | $15/1M tokens |

| DeepSeek V4 (claimed) | 80%+ | 1M tokens | $0.27/1M tokens |

| DeepSeek V3.2 | 72.4% | 256K tokens | $0.14/1M tokens |

If V4 delivers claimed performance at claimed costs, the value proposition becomes stark: comparable coding capability at 10-40x lower inference costs.

Consumer Hardware Deployment

In a notable departure from infrastructure trends, DeepSeek V4 runs on consumer hardware:

- Consumer Tier: Dual RTX 4090s or single RTX 5090

- Professional Tier: Single workstation-class GPU (RTX 6000 Ada)

- Enterprise Tier: Standard data center configurations

MLA compression enables inference on a single RTX 4090 (24GB GDDR6X). By batching 4 requests with shared KV caches, effective memory footprint falls below 5GB per request, achieving approximately 550 tokens/second throughput with batch size of 4.

| Hardware Configuration | Model Capacity | Tokens/Second | Memory Required |

|---|---|---|---|

| Single RTX 4090 (24GB) | V4 32B distilled | 30-35 | 24GB VRAM + 64GB RAM |

| Dual RTX 4090 (48GB) | V4 70B distilled | 25-30 | 48GB VRAM + 128GB RAM |

| RTX 5090 (32GB) | V4 70B quantized | 40-50 | 32GB VRAM + 64GB RAM |

| 4x RTX 4090 (96GB) | V4 full weights | 15-20 | 96GB VRAM + 256GB RAM |

For comparison, running GPT-4-class models locally typically required specialized infrastructure costing $50,000+. V4's efficiency innovations potentially democratize access to trillion-parameter capabilities.

The anticipated RTX 5090 with 32GB of GDDR7 closes the gap further. While still requiring offloading for full models, faster memory bandwidth and Blackwell architecture should enable near-real-time inference on single consumer cards.

Open Source Strategy

DeepSeek has open-sourced V4 weights under Apache 2.0 licensing, continuing their strategy of releasing frontier capabilities publicly. This contrasts sharply with Western competitors—GPT-5, Claude Opus, and Gemini remain closed-source.

| Model | Weights Available | License | Self-Hosting |

|---|---|---|---|

| DeepSeek V4 | Yes | Apache 2.0 | Full support |

| GPT-5.2 | No | Proprietary | API only |

| Claude Opus 4.5 | No | Proprietary | API only |

| Gemini Ultra | No | Proprietary | API only |

| Llama 4 | Yes | Custom license | Restricted commercial |

Open weights transform deployment economics:

- On-premises deployment: Air-gapped environments, data sovereignty compliance

- Quantization: Running reduced-precision versions on consumer hardware

- Fine-tuning: Custom models for specific enterprise needs

- Cost optimization: Avoiding per-token charges for high-volume applications

Organizations with strict data governance can run V4 entirely within their infrastructure. For industries like finance, healthcare, and defense, this eliminates concerns about sending proprietary code to external APIs.

API Pricing Disruption

DeepSeek's pricing already undercuts competitors significantly. Current V3 pricing: $0.27 per million input tokens versus approximately $15/million for GPT-4.5 and Claude Opus.

| Provider | Model | Input (per 1M) | Output (per 1M) | Context |

|---|---|---|---|---|

| DeepSeek | V4 | $0.27 | $1.10 | 1M tokens |

| DeepSeek | V3.2 | $0.14 | $0.55 | 256K tokens |

| OpenAI | GPT-5.2 | $15.00 | $60.00 | 256K tokens |

| Anthropic | Opus 4.5 | $15.00 | $75.00 | 200K tokens |

| Gemini Pro | $3.50 | $10.50 | 128K tokens |

A practical example: A 100K token context costs $5.50 on GPT-4 versus $0.90 on DeepSeek V3.2-Exp. V4's million-token context at $0.27/million input tokens makes previously impossible use cases economically viable.

One cost analysis showed a hybrid approach using DeepSeek for extraction plus Claude for audit reduced API spend by 72% while improving factual accuracy by 12% compared to pure GPT-5.

Training Infrastructure Reality Check

Despite efficiency claims, DeepSeek's training infrastructure remains substantial. The company reportedly trained R1 on 50,000 Hopper-series GPUs—30,000 HGX H20 units, 10,000 H800s, and 10,000 H100s—supplied through investor High-Flyer Capital Management.

Chinese authorities urged DeepSeek to use Huawei Ascend hardware for R2 training. The move encountered unstable performance, slower chip-to-chip connectivity, and limitations of Huawei's CANN software toolkit. Despite Huawei deploying engineers on-site, DeepSeek couldn't complete a successful training run.

The result: DeepSeek reverted to NVIDIA accelerators for R2 training while keeping Huawei hardware for inference. This reveals both the current limits of Chinese domestic chips and DeepSeek's pragmatic approach—they'll use whatever works, regardless of political pressure.

Huawei CEO Ren Zhengfei acknowledged that "the US has exaggerated Huawei's achievements" and that their best chips remain a generation behind. However, industry observers expect some large language models to train on Chinese chips by end of 2026, with the trend becoming more apparent in 2027.

Geopolitical Implications

DeepSeek's rapid rise signals a major shift in global AI competition. The company's R1 launch triggered a $1 trillion tech stock selloff on January 27, 2025—including $600 billion from NVIDIA alone.

President Trump called it a "wake-up call" for US companies. Cloud providers like Alphabet, Microsoft, and Amazon—the latter two having invested heavily in OpenAI and Anthropic—now face a pricing crisis.

Regional adoption patterns have diverged sharply:

| Region | Adoption Level | Primary Driver |

|---|---|---|

| China | 89% market share | Cost, performance, local development |

| Global South | High/Growing | Open source, low compute requirements |

| Western Enterprise | Low/Moderate | Cost savings, on-premises deployment |

| Western Government | Banned | Security concerns, data sovereignty |

Since August 2025, cumulative open-source downloads of Chinese AI models have surpassed Western competitors—marking a significant shift in global AI usage patterns. In China, DeepSeek reportedly commands nearly 89% market share among AI users.

Western government adoption remains minimal. Australia and allied nations have banned DeepSeek from official devices, with up to 70% of Australian businesses actively blocking access due to data security concerns.

Competitive Response

Western competitors have adjusted pricing and products in response to DeepSeek pressure:

- Google: Reduced Gemini API costs throughout 2024 and 2025

- OpenAI: Lowered rates and released o3-mini in January 2026 to compete on efficiency

- Anthropic: Maintained pricing but emphasized Verifiable Safety Stack for regulated industries

There's a hidden cost consideration: verification overhead. Using cheap models often requires spending tokens on expensive models to verify outputs. Audits show a "Cheap Model + High-End Auditor" setup can cost 15% more than just using GPT-5 for medium-complexity tasks.

For enterprises in regulated industries, Claude's Verifiable Safety Stack provides audit trails that justify premium pricing. The EU AI Act's enforcement has made compliance documentation as valuable as raw performance.

Infrastructure Implications

DeepSeek's efficiency innovations don't invalidate current GPU demand. Hyperscaler CapEx continues growing, with $600+ billion projected for 2026. But the composition of spending—what gets built and how it gets used—may shift.

Engram's approach to context handling emphasizes memory hierarchy over raw compute. Future training infrastructure might prioritize high-bandwidth memory and efficient caching over peak FLOPS.

For data center operators, several trends emerge:

- Memory bandwidth becomes critical: Engram's DRAM offloading technique shifts workloads from GPU memory to system RAM

- Inference infrastructure diversifies: Consumer-grade deployment enables edge and on-premises installations

- Training remains centralized: Despite efficiency gains, frontier model training still requires massive GPU clusters

- Hybrid architectures gain traction: DeepSeek extraction + Western model verification reduces costs while maintaining compliance

Key Takeaways

For AI Infrastructure Teams:

- DeepSeek V4's consumer hardware deployment (dual RTX 4090s) transforms on-premises AI economics

- Engram's memory architecture shifts hardware priorities toward high-bandwidth DRAM

- Open weights enable fine-tuning and deployment without API dependencies

For Enterprise Decision Makers:

- 10-40x cost reductions make previously uneconomical AI applications viable

- Security concerns require clear policies on Chinese model usage

- Hybrid deployment (DeepSeek extraction + Western verification) offers cost-performance balance

For Data Center Operators:

- Million-token contexts change workload profiles and memory requirements

- Consumer GPU deployment creates demand for smaller, distributed inference infrastructure

- Efficiency gains don't eliminate demand—they expand what's economically possible

About Introl

Introl provides specialized GPU infrastructure deployment for AI data centers. With 550 HPC-specialized field engineers across 257 global locations, Introl has deployed over 100,000 GPUs—supporting everything from hyperscale training clusters to edge inference infrastructure. Whether organizations deploy DeepSeek, proprietary models, or hybrid architectures, Introl's expertise ensures reliable, performant AI infrastructure.