Small modular reactors (SMRs) are poised to become the backbone of AI infrastructure, with tech giants committing over $10 billion to nuclear partnerships and 22 gigawatts of projects in development globally. The first commercial SMR-powered data centers will come online by 2030, marking a pivotal shift in how we power the digital economy. This convergence of nuclear technology and artificial intelligence addresses a critical challenge: AI data centers will consume 945 terawatt-hours annually by 2030—equivalent to the entire electricity consumption of Japan—while demanding 24/7 carbon-free power that only nuclear can reliably provide.

How SMRs work differently from traditional nuclear power

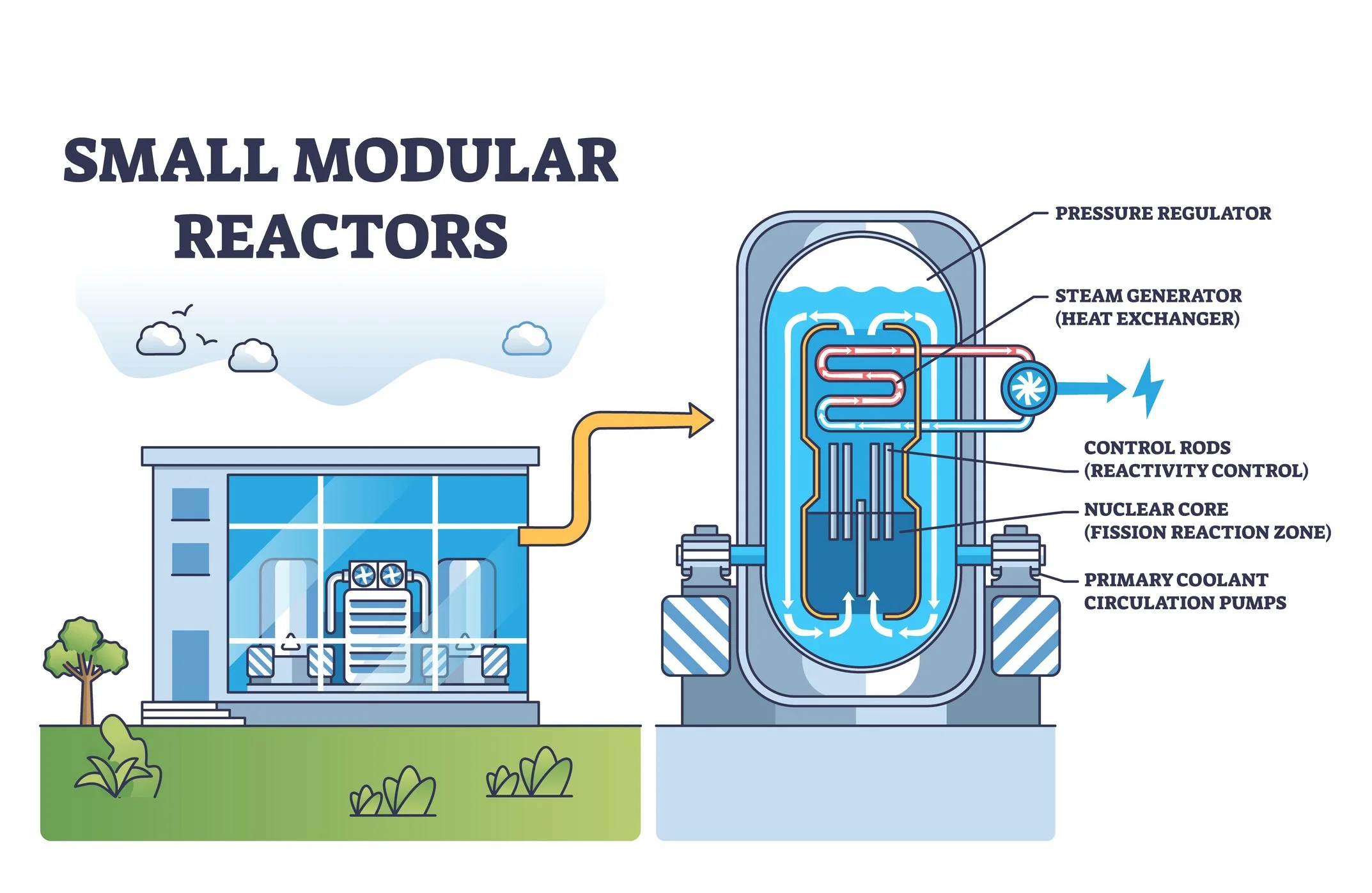

SMRs fundamentally reimagine nuclear power through factory fabrication and modular design. Unlike traditional reactors custom-built on-site over 5-10 years, SMR components are manufactured in controlled factory environments and shipped as standardized modules for assembly, reducing construction time to just 24-36 months. These reactors produce between 5 and 300 megawatts per module compared to over 1,000 MW for conventional nuclear plants, enabling flexible deployment that matches specific power needs.

The core innovation lies in passive safety systems that rely on natural physical processes like gravity and convection rather than pumps, valves, and operator intervention. When NuScale's reactor shuts down, for instance, it can cool itself for seven days without any external power or human action—a feat impossible with traditional designs. The smaller radioactive inventory and underground deployment of many SMR designs create additional safety margins, with some advanced reactors like X-energy's Xe-100 using TRISO fuel that physically cannot melt even at temperatures exceeding 1,600°C.

Current SMR designs span six technology families, from proven pressurized water reactors to advanced molten salt and high-temperature gas systems. NuScale's 77-megawatt modules can be combined in configurations of 4, 6, or 12 units to create plants ranging from 308 to 924 MW. Meanwhile, TerraPower's Natrium reactor pairs a 345 MW sodium-cooled reactor with molten salt energy storage, enabling output to surge to 500 MW during peak demand—perfect for the variable loads of AI training workloads.

Cost comparisons reveal both challenges and opportunities. While current first-of-a-kind SMR projects face capital costs of $3,000-6,000 per kilowatt, manufacturers project these will fall below conventional nuclear's $7,675-12,500/kW through series production. The levelized cost of electricity from SMRs currently ranges from $89-102 per megawatt-hour, higher than wind and solar at $26-50/MWh but competitive with reliable baseload alternatives when considering capacity factors exceeding 95%.

## The AI infrastructure crisis is driving nuclear adoption. Modern GPU data centers have become voracious energy consumers, with power demands escalating at unprecedented rates. NVIDIA's latest Blackwell B200 GPUs consume up to 1,200 watts each, while future AI accelerator racks reach 240 kilowatts—equivalent to powering 200 American homes. A single large-scale AI training cluster can demand 500 megawatts of continuous power, roughly equivalent to a mid-sized city.

The collective impact is staggering: deployed H100 GPUs alone will consume 13.8 terawatt-hours in 2024, matching the entire electricity consumption of countries like Georgia or Costa Rica. Data center electricity demand in the United States will surge from 4% to 9-12% of total consumption by 2030, with global demand growing 160% to reach 945 TWh annually. This growth trajectory has pushed tech companies to secure dedicated power sources, as traditional grid infrastructure cannot scale quickly enough to meet demand.

SMRs offer unique advantages for powering these facilities. Their modular scalability allows precise matching to data center growth—starting with a single 77 MW module and expanding as computational needs increase. The 24/7 baseload generation eliminates the intermittency challenges of renewables, crucial for AI workloads that cannot tolerate power interruptions. Perhaps most importantly, SMRs enable grid independence, allowing data centers to operate without competing with local communities for electricity or waiting years for transmission upgrades.

The technical integration between SMRs and data centers creates remarkable cohesiveness. Data centers already require sophisticated cooling systems to manage heat from GPUs, with liquid cooling markets growing at 20.3% annually to handle rack densities exceeding 100kW. SMRs can provide both electricity and process heat for absorption chillers, while data center waste heat at 35-45°C proves ideal for district heating applications. This combined heat and power approach can boost overall system efficiency above 80%, transforming waste streams into valuable resources.

The nuclear arms race among tech giants.

The race to secure nuclear power has triggered an unprecedented wave of partnerships and investments. Amazon Web Services leads with the most ambitious program, committing to deploy 5 gigawatts of SMR capacity by 2039 through a $500 million investment in X-energy and partnerships spanning Washington State and Virginia. Their Energy Northwest agreement will initially deploy four Xe-100 reactors producing 320 MW, with expansion potential to 960 MW across twelve modules.

Google made history in October 2024 with the world's first corporate SMR purchase agreement, partnering with Kairos Power to deploy 500 megawatts across 6-7 molten salt reactors. The first unit will come online by 2030, with full deployment by 2035. This agreement provides the critical "orderbook" demand signal that SMR manufacturers need to justify factory investments and achieve economies of scale.

Microsoft has taken a different initial approach, signing a 20-year agreement with Constellation Energy to restart Three Mile Island Unit 1, securing 837 megawatts of carbon-free power by 2028. The company has simultaneously built an internal nuclear team, hiring directors of atomic technology from Ultra Safe Nuclear and Tennessee Valley Authority to develop a comprehensive SMR strategy for its global data center fleet.

Current construction represents a watershed moment for the industry. TerraPower broke ground on its Natrium reactor in Kemmerer, Wyoming, in June 2024—the first commercial advanced reactor construction in the United States. This $4 billion project, backed by the Department of Energy and Bill Gates, will replace a retiring coal plant with 345 MW of clean power by 2030. The facility's integrated molten salt storage system enables it to boost output to 500 MW for five hours, ideally suited for AI workload variations.

Global deployment accelerates beyond US borders.

While the United States leads in announced projects, international markets are rapidly developing their own SMR capabilities. China's Linglong One became the world's first operational commercial land-based SMR in 2023, producing 210 MW at Hainan Province. The nation has allocated an estimated $25-35 billion for domestic deployment and positions itself to capture significant export market share.

Canada has emerged as another early leader, with Ontario Power Generation receiving construction approval for a GE Hitachi BWRX-300 at the Darlington site in April 2025. This CAD 7.7 billion project targets operation by 2029, with three additional units planned for CAD 13.2 billion. The proven boiling water reactor technology promises 60% capitalcosts than conventional nuclear plants.

The European Union selected nine SMR projects for its Industrial Alliance in October 2024, spanning technologies from lead-cooled fast reactors to molten salt systems. Poland alone has committed to multiple SMR deployments to replace coal plants, with ORLEN Synthos Green Energy leading a 17-company consortium across 11 countries. Romania plans to deploy NuScale's six-module VOYGR plant by 2029, becoming the first European nation with an operational SMR.

The United Kingdom has bet heavily on Rolls-Royce's 470-megawatt SMR design, providing £280 million in government funding matched by private investment. The technology progressed to the final phase of regulatory assessment in 2025, with four sites identified for deployment and grid connection targeted for the mid-2030s. Construction partners Laing O'Rourke and BAM bring critical infrastructure expertise to accelerate deployment.

The technology roadmap promises dramatic advances.

The next decade will witness a fundamental transformation in nuclear technology deployment. First-generation SMRs like NuScale's 77 MW modules and GE Hitachi's BWRX-300 rely on proven light-water reactor technology, enabling deployment by 2030 with existing fuel infrastructure and regulatory frameworks. These designs achieve enhanced safety through passive systems while maintaining compatibility with current nuclear supply chains.

Generation IV advanced reactors arriving in the early 2030s will unlock new capabilities. Molten salt reactors operate at atmospheric pressure with fuel dissolved in liquid salt, enabling continuous operation for up to 150 months without refueling. High-temperature gas reactors like X-energy's Xe-100 reach 750°C, opening applications in hydrogen production and industrial process heat. TerraPower's sodium-cooled Natrium design integrates thermal storage, transforming nuclear plants into dispatchable resources that complement renewable grids.

Microreactors represent the frontier of nuclear innovation, with designs from Oklo, Westinghouse, and others providing 1-30 megawatts in factory-sealed units. These reactors can operate for decades without refueling, enabling deployment in remote locations or as distributed power for edge computing facilities. Oklo's Aurora powerhouse has secured agreements for 12 gigawatts of deployment through 2044, demonstrating massive market appetite for simplified nuclear solutions.

Cost projections show a clear path to competitiveness. Wood Mackenzie forecasts SMR costs falling to $120 per megawatt-hour by 2030 as manufacturers achieve learning rates of 5-10% per doubling of capacity. After 5-7 units or 10-20 GW of installed capacity, the technology will reach the learning curve plateau where further cost reductions moderate. Strategic factory investments and supply chain development will prove critical to achieving these targets.

Regulatory reform accelerates deployment timelines.

The regulatory landscape has transformed dramatically to enable SMR deployment. President Biden's Executive Order 14300 mandates 18-month maximum review timelines for new reactor applications, compared to historical 5-7 year processes. The Nuclear Regulatory Commission is developing Part 53, an entirely new licensing framework tailored to advanced reactors that emphasizes performance-based standards over prescriptive requirements.

International harmonization efforts through the IAEA's Nuclear Harmonization and Standardization Initiative promise to enable global deployment of standardized designs. The SMR Regulators' Forum brings together authorities from the United States, Canada, the United Kingdom, and other nations to develop common approaches to safety assessment. These coordinated efforts could reduce the time and cost of deploying proven designs across multiple countries.

The ADVANCE Act of 2024 introduced critical reforms, including 50% fee reductions for SMR applications and new pathways for demonstration reactors at Department of Energy sites. Manufacturing licenses will enable factory production of certified modules, while the new regulatory framework accommodates multi-site deployment of standard designs. Early site permits and design certifications can now proceed in parallel, shaving years off project timelines.

The path forward balances promise with challenges.

The SMR revolution faces significant headwinds despite strong momentum. Capital costs remain high at $3,000-6,000 per kilowatt for first-of-a-kind projects, requiring patient capital and government support. The high-assay low-enriched uranium (HALEU) fuel needed by many advanced designs currently depends on Russian supply, though domestic production facilities are under development. Public acceptance remains mixed, with communities weighing clean energy benefits against nuclear safety concerns shaped by historical accidents.

Technical challenges persist in areas from materials qualification to waste management. Some SMR designs may produce 2-30 times more radioactive waste volume than conventional reactors, though with lower total radioactivity. Supply chain development requires rebuilding nuclear manufacturing capabilities that have been dormant for decades. Workforce training must accelerate to provide the specialized skills needed for SMR construction and operation.

The infrastructure complexity of integrating SMRs with AI data centers requires specialized expertise. Companies must navigate everything from high-density GPU deployments consuming hundreds of kilowatts per rack to sophisticated liquid cooling systems managing extreme heat loads. Infrastructure specialists like Introl, with experience deploying over 100,000 GPUs globally and managing complex data center migrations, understand the unique challenges of scaling AI infrastructure. Their expertise across APAC markets positions them to support the convergence of nuclear power and AI computing infrastructure as these technologies expand globally.

Yet the convergence of forces driving SMR adoption appears unstoppable. Tech companies' insatiable power demands, net-zero commitments by 2030-2040, and grid infrastructure limitations create a perfect storm favoring nuclear solutions. Government support exceeding $5.5 billion in the United States alone, matched by billions in private investment, provides the capital needed to overcome initial deployment hurdles. Most critically, the alternative—constraining AI development due to power limitations—is unthinkable for companies and nations competing for technological leadership.

Conclusion

Small modular reactors stand at the intersection of two defining challenges of our time: powering the AI revolution and achieving deep decarbonization. The technology has progressed from concept to construction, with the first units breaking ground and tech giants committing billions to secure future capacity. By 2030, SMRs will begin powering data centers from Wyoming to Washington State, proving whether factory-built nuclear can deliver on promises of enhanced safety, accelerated deployment, and competitive costs.

The next five years will determine whether SMRs become a cornerstone of 21st-century energy infrastructure or remain a transitional technology. Success requires continued regulatory reform, achievement of manufacturing scale, resolution of fuel supply constraints, and—perhaps most importantly—flawless execution of first-generation projects. The companies, communities, and countries that master SMR deployment will gain decisive advantages in the AI era, where computational power increasingly determines economic and strategic competitiveness. The nuclear renaissance has begun; its ultimate impact will reshape how we generate and consume energy for generations to come.

References

Amazon. "Amazon enlists nuclear small modular reactors in push for net carbon-zero." About Amazon. 2024. https://www.aboutamazon.com/news/sustainability/amazon-nuclear-small-modular-reactor-net-carbon-zero.

ANS. "NRC accepts TerraPower's SMR construction permit." Nuclear Newswire. 2025. https://www.ans.org/news/article-6073/nrc-accepts-terrapowers-smr-construction-permit/.

———. "X-energy, Dow apply to build an advanced reactor project in Texas." Nuclear Newswire. March 31, 2025. https://www.ans.org/news/2025-03-31/article-6902/xenergy-dow-apply-to-build-an-advanced-reactor-project-in-texas/.

Bis Research. "Top 10 Startups Powering Data Centers with Small Modular Reactors." 2024. https://bisresearch.com/insights/top-10-startups-revolutionizing-data-center-energy-with-small-modular-reactors.

Bisnow. "Data Center REIT Equinix Inks Deal To Buy Nuclear Power From Sam Altman-Backed Firm." 2024. https://www.bisnow.com/national/news/data-center/data-center-reit-equinix-inks-power-deal-with-sam-altman-backed-nuclear-startup-oklo-123688.

C3 Solutions. "Five of the World's Leading Small Modular Reactor Companies." C3 News Magazine. 2024. https://c3newsmag.com/five-of-the-worlds-leading-small-modular-reactor-companies/.

Carbon Credits. "NuScale Secures NRC Approval for 77 MWe SMR Design, Advancing U.S. Nuclear Innovation." 2025. https://carboncredits.com/nuscale-secures-nrc-approval-for-77-mwe-smr-design-advancing-u-s-nuclear-innovation/.

———. "US Data Center Power Use Will Double by 2030 Because of AI." 2024. https://carboncredits.com/us-data-centers-power-requirement-will-double-by-2030/.

———. "What is SMR? The Ultimate Guide to Small Modular Reactors." 2024. https://carboncredits.com/the-ultimate-guide-to-small-modular-reactors/.

CNBC. "Oracle is designing a data center that would be powered by three small nuclear reactors." September 10, 2024. https://www.cnbc.com/2024/09/10/oracle-is-designing-a-data-center-that-would-be-powered-by-three-small-nuclear-reactors.html.

CNN. "New-wave reactor technology could kick-start a nuclear renaissance — and the US is banking on it." February 1, 2024. https://www.cnn.com/2024/02/01/climate/nuclear-small-modular-reactors-us-russia-china-climate-solution-intl/index.html.

Cybercareers. "Why Google, Meta, Microsoft and Amazon are investing in nuclear power." Cybersecurity Careers Blog. December 2024. https://www.cybercareers.blog/2024/12/why-google-meta-microsoft-and-amazon-are-investing-in-nuclear-power/.

Data Center Dynamics. "Amazon invests in nuclear SMR company, signs several SMR deals to power data centers." 2024. https://www.datacenterdynamics.com/en/news/amazon-signs-deals-to-invest-in-nuclear-smrs-to-power-data-centers/.

———. "Google signs nuclear SMR deal with Kairos for data center power." 2024. https://www.datacenterdynamics.com/en/news/google-signs-nuclear-smr-deal-with-kairos-for-data-center-power/.

———. "Three Mile Island nuclear power plant to return as Microsoft signs 20-year, 835MW AI data center PPA." 2024. https://www.datacenterdynamics.com/en/news/three-mile-island-nuclear-power-plant-to-return-as-microsoft-signs-20-year-835mw-ai-data-center-ppa/.

Data Center Frontier. "Google and Amazon Make Major Inroads with SMRs to Bring Nuclear Energy to Data Centers." 2024. https://www.datacenterfrontier.com/energy/article/55235902/google-and-amazon-make-major-inroads-with-smrs-to-bring-nuclear-energy-to-data-centers.

Data Center Knowledge. "Going Nuclear: A Guide to SMRs and Nuclear-Powered Data Centers." 2024. https://www.datacenterknowledge.com/energy-power-supply/going-nuclear-a-guide-to-smrs-and-nuclear-powered-data-centers.

———. "Nuclear-Powered Data Centers: When Will SMRs Finally Take Off?" 2024. https://www.datacenterknowledge.com/energy-power-supply/nuclear-powered-data-centers-when-will-smrs-finally-take-off-.

Dow. "Dow's Seadrift, Texas location selected for X-energy advanced SMR nuclear project to deliver safe, reliable, zero carbon emissions power and steam production." 2023. https://corporate.dow.com/en-us/news/press-releases/dow-s-seadrift--texas-location-selected-for-x-energy-advanced-sm.html.

Danisesne. "Nvidia's H100 microchips energy consumption." Electronic Specifier. 2024. https://www.electronicspecifier.com/news/analysis/nvidia-s-h100-microchips-projected-to-surpass-energy-consumption-of-entire-nations/.

Enerdata. "Small Modular Reactors: Advancing Nuclear Power Generation for a Sustainable Future." 2024. https://www.enerdata.net/publications/executive-briefing/smr-world-trends.html.

———. "SMR Technology Trends Worldwide." 2024. https://www.enerdata.net/publications/executive-briefing/smr-world-trends.html.

European Commission. "Small Modular Reactors explained." 2024. https://energy.ec.europa.eu/topics/nuclear-energy/small-modular-reactors/small-modular-reactors-explained_en.

Euronews. "Amazon follows Google in taking the nuclear option to power data centres." October 17, 2024. https://www.euronews.com/business/2024/10/17/amazon-follows-google-in-taking-the-nuclear-option-to-power-data-centres.

FiberMall. "Nvidia's B200 GPU Revealed: Power Consumption Reaches 1000W." 2024. https://www.fibermall.com/news/nvidia-b200-gpu-revealed.htm.

GlobeNewswire. "Data Center Liquid Cooling Global Business Report 2024-2030 - Integration of IoT in Data Centers Sets the Stage for Innovative Liquid Cooling Solutions." September 2, 2024. https://www.globenewswire.com/news-release/2024/09/02/2939078/28124/en/Data-Center-Liquid-Cooling-Global-Business-Report-2024-2030-Integration-of-IoT-in-Data-Centers-Sets-the-Stage-for-Innovative-Liquid-Cooling-Solutions.html.

Goldman Sachs. "AI is poised to drive 160% increase in data center power demand." 2024. https://www.goldmansachs.com/insights/articles/AI-poised-to-drive-160-increase-in-power-demand.

———. "AI to drive 165% increase in data center power demand by 2030." 2024. https://www.goldmansachs.com/insights/articles/ai-to-drive-165-increase-in-data-center-power-demand-by-2030.

———. "Is nuclear energy the answer to AI data centers' power consumption?" 2024. https://www.goldmansachs.com/insights/articles/is-nuclear-energy-the-answer-to-ai-data-centers-power-consumption.

Google. "Google signs advanced nuclear clean energy agreement with Kairos Power." Google Blog. October 14, 2024. https://blog.google/outreach-initiatives/sustainability/google-kairos-power-nuclear-energy-agreement/.

IAEA. "Molten salt reactors (MSR)." International Atomic Energy Agency. 2024. https://www.iaea.org/topics/molten-salt-reactors.

———. "Small modular reactors (SMR)." International Atomic Energy Agency. 2024. https://www.iaea.org/topics/small-modular-reactors.

———. "What are Molten Salt Reactors (MSRs)?" International Atomic Energy Agency. 2024. https://www.iaea.org/newscenter/news/what-are-molten-salt-reactors.

———. "What are Small Modular Reactors (SMRs)?" International Atomic Energy Agency. 2024. https://www.iaea.org/newscenter/news/what-are-small-modular-reactors-smrs.

IEA. "AI is set to drive surging electricity demand from data centres while offering the potential to transform how the energy sector works." International Energy Agency. 2024. https://www.iea.org/news/ai-is-set-to-drive-surging-electricity-demand-from-data-centres-while-offering-the-potential-to-transform-how-the-energy-sector-works.

IEEE Spectrum. "Big Tech Embraces Nuclear Power to Fuel AI and Data Centers." 2024. https://spectrum.ieee.org/nuclear-powered-data-center.

IEEFA. "Eye-popping new cost estimates released for NuScale small modular reactor." Institute for Energy Economics and Financial Analysis. 2023. https://ieefa.org/resources/eye-popping-new-cost-estimates-released-nuscale-small-modular-reactor.

Introl. "Coverage Area." Accessed August 5, 2025. https://introl.com/coverage-area.

Lastenergy. "On-Site Nuclear Power: SMRs Create New Opportunities for Colocation Data Centers." 2024. https://www.lastenergy.com/blog/smrs-colocation-data-centers.

MarketsandMarkets. "Small Modular Reactor Market | Size, Share, and Analysis - 2030." 2024. https://www.marketsandmarkets.com/Market-Reports/small-modular-reactor-market-5001546.html.

Neutron Bytes. "Dow & X-Energy Submit Construction License to NRC for Texas Site." April 2, 2025. https://neutronbytes.com/2025/04/02/doe-x-energy-submit-construction-license-to-nrc-for-texas-site/.

NPR. "Three Mile Island nuclear plant will reopen to power Microsoft data centers." September 20, 2024. https://www.npr.org/2024/09/20/nx-s1-5120581/three-mile-island-nuclear-power-plant-microsoft-ai.

Nuclear Business Platform. "Top 5 SMR Tech to Keep an Eye on in 2025." 2025. https://www.nuclearbusiness-platform.com/media/insights/top-5-smr-tech.

Nuclear Engineering International. "European Alliance to support selected SMR projects." 2024. https://www.neimagazine.com/news/european-alliance-to-support-selected-smr-projects/.

NucNet. "Big Tech / Meta Joins Race For Nuclear Power For Data Centres And AI Boom." December 3, 2024. https://www.nucnet.org/news/meta-joins-race-for-nuclear-power-for-data-centres-and-ai-boom-12-3-2024.

NuScale Power. "NuScale Power | Small Modular Reactor (SMR) Nuclear Technology." 2025. https://www.nuscalepower.com/.

———. "NuScale Power's Small Modular Reactor (SMR) Achieves Standard Design Approval from U.S. Nuclear Regulatory Commission for 77 MWe." 2025. https://www.nuscalepower.com/press-releases/2025/nuscale-powers-small-modular-reactor-smr-achieves-standard-design-approval-from-us-nuclear-regulatory-commission-for-77-mwe.

———. "The NuScale Power Module." 2025. https://www.nuscalepower.com/products/nuscale-power-module.

Power Engineering. "Oklo secures up to 750 MW-worth of new data center partnerships." 2024. https://www.power-eng.com/nuclear/oklo-secures-up-to-750-mw-worth-of-new-data-center-partnerships/.

POWER Magazine. "Europe's SMR Alliance Endorses Nine Nuclear Projects in Push for 2030s Deployment." 2024. https://www.powermag.com/europes-smr-alliance-endorses-nine-nuclear-projects-in-push-for-2030s-deployment/.

———. "The SMR Gamble: Betting on Nuclear to Fuel the Data Center Boom." 2024. https://www.powermag.com/the-smr-gamble-betting-on-nuclear-to-fuel-the-data-center-boom/.

Quartz. "Amazon is joining Google and Microsoft in going big on nuclear power." 2024. https://qz.com/amazon-google-microsoft-nuclear-power-ai-data-centers-1851673653.

ResearchGate. "LCOE for SMRs and Some Alternative Sources, for Different Regions (at... | Download Scientific Diagram." 2013. https://www.researchgate.net/figure/LCOE-for-SMRs-and-Some-Alternative-Sources-for-Different-Regions-at-5-Real-Discount_fig1_264149505.

Rolls-Royce SMR. "To Deliver Clean, Affordable Energy For All." 2025. https://www.rolls-royce-smr.com/.

S&P Global Commodity Insights. "Global data center power demand to double by 2030 on AI surge: IEA." April 10, 2025. https://www.spglobal.com/commodity-insights/en/news-research/latest-news/electric-power/041025-global-data-center-power-demand-to-double-by-2030-on-ai-surge-iea.

ScienceDirect. "Techno-economic analysis of advanced small modular nuclear reactors." 2023. https://www.sciencedirect.com/science/article/abs/pii/S0306261923000338.

Scientific American. "AI Will Drive Doubling of Data Center Energy Demand by 2030." 2024. https://www.scientificamerican.com/article/ai-will-drive-doubling-of-data-center-energy-demand-by-2030/.

Small-modular-reactors.org. "List of 20 SMR Companies | Reactor designs." 2024. https://small-modular-reactors.org/list-of-20-smr-companies/.

Sustainable Tech Partner. "Will Nuclear Energy Power AI Data Centers? Timeline of Developments, Proponents and Safety Discussions." 2024. https://sustainabletechpartner.com/news/will-nuclear-energy-power-ai-data-centers-timeline-of-developments-proponents-and-safety-discussions/.

TechCrunch. "Amazon joins the big nuclear party, buying 1.92 GW for AWS." June 13, 2025. https://techcrunch.com/2025/06/13/amazon-joins-the-big-nuclear-party-buying-1-92-gw-for-aws/.

TerraPower. "TerraPower Begins Construction on Advanced Nuclear Project in Wyoming." 2024. https://www.terrapower.com/terrapower-begins-construction-in-wyoming.

———. "TerraPower Natrium | Advanced Nuclear Energy." 2025. https://www.terrapower.com/natrium/.

The Register. "Microsoft hires leaders for nuclear datacenter program." January 23, 2024. https://www.theregister.com/2024/01/23/microsoft_nuclear_hires/.

Tom's Hardware. "Oracle will use three small nuclear reactors to power new 1-gigawatt AI data center." 2024. https://www.tomshardware.com/tech-industry/oracle-will-use-three-small-nuclear-reactors-to-power-new-1-gigawatt-ai-data-center.

Ultra Safe Nuclear. "Micro Modular Reactor - Advanced Nuclear HTGR." 2025. https://www.usnc.com/mmr/.

Utility Dive. "New nuclear power could meet 10% of projected data center demand increase by 2035: Deloitte." 2025. https://www.utilitydive.com/news/nuclear-power-smr-data-center-deloitte/745390/.

———. "NRC commissioners order changes to proposed licensing rules for advanced reactors." 2024. https://www.utilitydive.com/news/nrc-licensing-rules-advanced-nuclear-reactor-smr/709464/.

———. "Oklo inks 12-GW advanced reactor supply agreement with data center developer Switch." 2024. https://www.utilitydive.com/news/oklo-aurora-smr-advanced-nuclear-reactor-supply-agreement-data-center-developer-switch/735933/.

———. "TerraPower begins construction at 345-MW advanced reactor site in Wyoming." 2024. https://www.utilitydive.com/news/terrapower-smr-advanced-nuclear-reactor-bill-gates/718722/.

White House. "Ordering the Reform of the Nuclear Regulatory Commission." Presidential Actions. May 2025. https://www.whitehouse.gov/presidential-actions/2025/05/ordering-the-reform-of-the-nuclear-regulatory-commission/.

Wikipedia. "NuScale Power." Accessed August 5, 2025. https://en.wikipedia.org/wiki/NuScale_Power.

———. "Rolls-Royce SMR." Accessed August 5, 2025. https://en.wikipedia.org/wiki/Rolls-Royce_SMR.

———. "Small modular reactor." Accessed August 5, 2025. https://en.wikipedia.org/wiki/Small_modular_reactor.

Wood Mackenzie. "Global policy support for nuclear expands to address challenges of reliable, low-carbon energy supplies." 2024. https://www.woodmac.com/press-releases/global-policy-support-for-nuclear-expands-to-address-challenges-of-reliable-low-carbon-energy-supplies/.

World Nuclear Association. "Molten Salt Reactors." 2024. https://world-nuclear.org/information-library/current-and-future-generation/molten-salt-reactors.

———. "Small Nuclear Power Reactors." 2024. https://world-nuclear.org/information-library/nuclear-fuel-cycle/nuclear-power-reactors/small-nuclear-power-reactors.

World Nuclear News. "Uprated NuScale SMR design gets US approval." 2025. https://www.world-nuclear-news.org/articles/uprated-nuscale-smr-design-gets-us-approval.

WyoFile. "Natrium 'advanced nuclear' power plant wins Wyoming permit." 2024. https://wyofile.com/natrium-advanced-nuclear-power-plant-wins-wyoming-permit/.

X-energy. "Nuclear Power Plants in TX | Dow & X-energy's South TX Nuclear Project at Seadrift." 2025. https://x-energy.com/seadrift.

———. "Xe-100 SMR Technology Explained: The Future of Nuclear Energy." 2025. https://x-energy.com/updates-all/technology-explainer.

———. "Xe-100: High-Temperature Gas-Cooled Nuclear Reactors (HTGR)." 2025. https://x-energy.com/reactors/xe-100.